Executive Summary

A prominent American department store chain, known for its wide range of products, recently made a strategic shift. To ensure accurate data and better customer insights, the store transitioned from its legacy Customer Data Platform (CDP) system to a modern, AI-powered CDP.

Factspan played a crucial role in this journey by streamlining the identity resolution process. They organized a seamless flow of customer information between the store’s internal system and the cloud-based CDP, eliminating the need for manual checks.

This collaboration improved data accuracy and provided deep insights into customer segments. Factspan’s involvement highlights the power of merging technology with business strategy, enhancing data management efficiency, and strengthening competitiveness.

About the Client

The client is a retail powerhouse with over 650+ stores across the United States, the company occupies a significant role in the realm of department stores. Its portfolio encompasses a diverse range, featuring fashion apparel, home goods, cosmetics, and electronics, catering to a wide spectrum of consumer needs

Business Challenge

1) The retailer faced a challenge validating data stitched by Amperity, a Customer Data Platform (CDP). This process was time-consuming and error-prone, especially with complex datasets. Traditional manual methods were inadequate, leading to potential inaccuracies and delays.

2) Identity Resolution (IDR links customer records from multiple sources for a unified view) slowed down, hindering the platform’s scalability for the growing customer base.

3) Data needed identification, gathering from both systems (legacy Customer Data Platform (CDP) and the AI-powered CDP), and comparison to resolve discrepancies promptly.

Our Solution

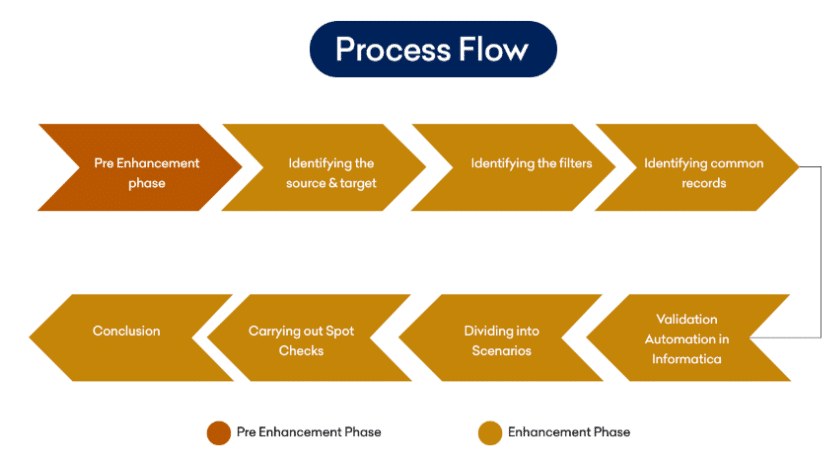

The Factspan team reviewed data for accuracy before developing an automated pipeline with IDQ Informatica. This pipeline efficiently handled records from the legacy Customer Data Platform (CDP) and AI-powered CDP. By using IDQ Informatica, the automated pipeline matched crucial Personally Identifiable Information (PII) fields, significantly enhancing Identity Resolution (IDR) precision while minimizing manual intervention.

Factspan strategically conducted spot checks for records falling below a specified match percentage threshold. This approach enhanced IDR accuracy by revealing underlying issues.

While most data was automatically processed accurately, manual spot checks were crucial for reliability. Excluding highly accurate data segments enabled focused efforts on challenging areas.

Factspan employed IDQ for probabilistic matching, identifying likely matches between customer records across data systems. This proactive strategy improved data reconciliation and identity resolution precision. In conclusion, the integration of automated flows, manual checks, advanced algorithms, and IDQ Informatica ensured IDR accuracy and empowered informed decisions based on deeper data understanding.

Tools used

GCP Big Query, Amperity, IDQ, Oracle

Business Impact

- Project bolstered decision confidence, fostering enriched customer data adoption • Enhanced accuracy and completeness of PII data

- IDR process time slashed from several hours to 45-60 minutes

- Achieved a 135% boost in average PII completion rate

- Realized an impressive 40% surge in resolved accounts’ value

Learn how our data processing solutions can enhance accuracy and speed in retail.

Featured content

Enhancing Retail Data Quality with Apach...

Technical Challenges In Building An Ente...

Data Quality Frameworks for Retail Opera...

Cloud Orchestration Upgrade to Transform...

Automating CCPA Compliant Customer Data ...

Enhanced Customer Analysis through Power...

Enhanced Customer Engagement through Uni...

CDP and UCV: The Secret Weapon for Retai...

Sentiment Analysis in Retail: Enhancing ...