Executive Summary

A mid-sized regional bank aimed to consolidate its fragmented customer data spread across multiple legacy CRM and core servicing platforms. The goal was to eliminate duplicate, inaccurate, and stale customer records, improving sales and marketing effectiveness while enabling better customer experiences. Additionally, the client sought to implement a global Customer ID to enable real-time fraud detection and ensure regulatory compliance.

To achieve this, Factspan helped the bank implement a cloud-based multi-domain master data management (MDM) solution powered by Reltio MDM. The new system streamlined customer record consolidation, enabled real-time fraud detection, and provided a unified view of customer interactions, ensuring compliance with GDPR, PCI-DSS, and Basel III regulations. By leveraging an AI-driven approach, the bank significantly reduced inefficiencies, improved operational workflows, and enhanced customer trust through accurate and reliable data.

About the Client

The client is a mid-sized regional bank that recently acquired a similar-sized retail banking institution. With multiple CRM applications, core servicing systems, and third-party marketing platforms, they faced significant data inconsistencies and inefficiencies in customer relationship management.

Business Challenge

The bank struggled with fragmented customer data across multiple CRM and core servicing platforms, leading to duplicate, stale, and inaccurate profiles. A recent acquisition introduced overlapping customer records, complicating integration. Poor data governance, inconsistent standards across home-grown systems, and lack of a global Customer ID impacted fraud detection, transaction monitoring, and compliance (GDPR, PCI-DSS, Basel III), leading to inefficiencies in sales, marketing, and credit decisions.

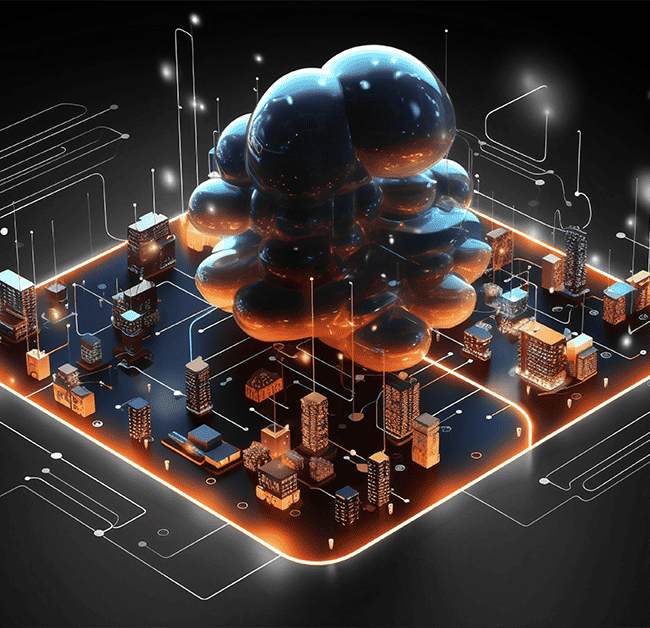

Our Solution

Factspan implemented a cloud-native multi-domain MDM solution powered by Reltio MDM, designed to eliminate duplicate records, enhance data governance, and enable seamless customer interactions. The solution was structured around three core areas:

- Automated Data Consolidation & Standardization: Using Reltio’s AI-driven matching and cleansing capabilities, the solution integrated customer records from multiple CRM and core servicing platforms, ensuring data consistency. The MDM system applied configurable rules for entity resolution, reducing stale, inaccurate, and duplicate profiles across channels.

- Fraud Detection & Regulatory Compliance: A global Customer ID framework was established to link disparate records across platforms, supporting real-time fraud detection, risk assessment, and transaction monitoring. The solution ensured compliance with GDPR, PCI-DSS, and Basel III by implementing robust data lineage tracking, encryption, and role-based access control (RBAC).

- Real-Time Data Accessibility & Business Insights: The cloud-based MDM architecture enabled real-time data enrichment by integrating third-party customer data sources, providing a unified and actionable customer profile. This improved sales targeting, personalized marketing efforts, and customer service operations, leading to enhanced customer experiences and more informed decision-making.

By leveraging Reltio MDM, the client achieved a unified and actionable customer profile, improving business decision-making and customer engagement.

Business Impact:

- 40% improvement in data accuracy, enhancing sales and marketing efficiency

- Reduced lost sales and bad credit decisions through accurate customer profiling

- Improved compliance with regulatory frameworks, reducing operational risks

- Enhanced customer experience with real-time, reliable data insights

Featured content

Modernizing Supply Chain & Vendor Ma...

The Future of Data Pipelines for Modern ...

Streamlining Product Data for an Automot...

Exploring Data Mesh – PoV...

Data Governance – Starter Kit...

Enhancing CX and Reducing OpEx for Truck...

AI-Driven Transformation in Trucking and...

Elevating Data Integration with ELTV Dat...

Evolving Data Stewardship Roles for Data...