AI forecasting systems can be modeled to help retailers manage data and business complexity by predicting the shelf movements of goods at a large scale. It enables the retailers to operate optimally during the tough cycles and minimize their sales volume disruptions.

Let’s assume you are running a retail store.

Prices are going up, consumer spending is coming down, margins are decreasing, and the expectation of a recession is increasing.

The alarm bells are ringing continuously in your board rooms to plan your business demand and funding, to overcome this uncertain future ahead.

While there are many uncontrollable parameters, the best way is to optimize the business to tap the full potential of the product sale opportunity.

Recession or not, forecasting is imminent to be better prepared for business fluctuations. But how can you design a forecasting model when the uncertainties are a plenty.

Can AI forecasting systems be put in place to help you enhance your day-to-day operations?

The simple answer is “Yes”.

AI (Artificial Intelligence) based forecasting system differs from traditional ones, as the former can manage complex data and recognize complicated patterns that emerges during a forecasting process. Retailers need to forecast at different granularities such as at product attribute (flavor/color) levels, and the complexity in the pattern makes AI systems better choice to manage, prepare model, and deploy models for large complex data sources.

Recession, due to its macro-economic nature, impacts the sales trajectory of certain goods to either become stand-still or make slower progress over longer periods of time. The latter scenario is particularly common for goods that are not planned in the regular purchase cycles (i.e., consumers can postpone their purchases if required).

This delay in the purchase cycle affects the shelf-movements of the retailer, forcing them to keep those goods for longer periods than necessary. This can become an obstacle to other fast moving consumer goods and possible loss of sales due to the trade-offs made and the potential sale opportunity.

In a large-scale organized retail chain, this scenario can potentially obstruct shelf-movements by up to millions in lost revenue.

By predicting well in advance, on how shelf-movements happen for different types of goods, the AI forecasting system can help retailers operate optimally during the recession periods to minimize disruptions to their margins.

Nevertheless, predicting such good sales/volumes across the stores are not straight forward and involves a comprehensive set of artificial intelligence algorithms, more specifically econometric modeling predicts appropriate volume/sales forecasts for 4 weeks to 5 weeks ahead.

AI forecasting systems can help retailers to better anticipate and manage different types of goods sales/volumes.

In this article, we will take you through a solution that can help predict goods sales with high levels of accuracy over 4 to 5 weeks horizon. The solution can be fully automated with machine learning techniques for speed and performance.

How or where to start?

The first step is to analyze existing data or collecting relevant data points.

- Use the Pareto rule: Start with questions like “Which segment of goods contribute to higher growth margins?” Does 80% of the margins come from 20% of fast-moving goods for the selected time-period? Evaluate at the store-shelf level to initiate the AI forecast solution.

- Go specific: What factors contribute to the sale of such goods identified? Are those goods available enough, if optimized? If not, need to find more relevant factors that affect goods movements. These cycles can be seasonal, local factors, etc.

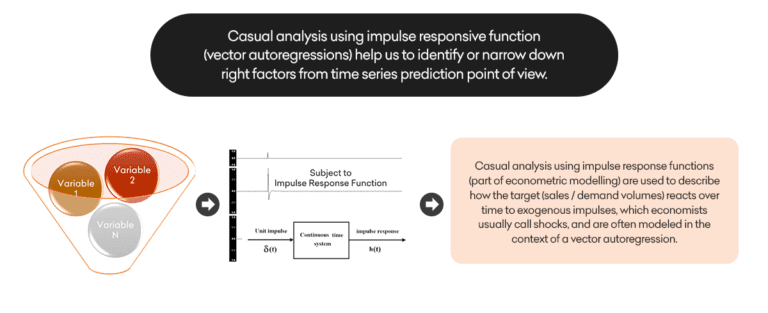

- Analyze the patterns: Once, certain factors are identified, you will need to apply Machine Learning techniques and confirm their impact with the help of impact analysis models. For instance, certain factors will have either lead/lag effects on the movements, i.e., consumers tend to purchase fast moving essentials usually in the beginning of the month.

- Identify cause & effect: Figure out the key data points that correlate factors that affect the sales/ volumes:

- What kind of causation will the factors have? Example: If we are looking for a short time, will an increase in one factor increase or decrease the sales of goods in the coming weeks

- Do such causations have fixed or variable lagged/lead effects? Do movements of goods follow a fixed pattern over those time periods (such as increased sales before major holidays/events like Thanksgiving, Christmas, etc.).

The next step is not about AI algorithms; but more about understanding and preparing the data for AI algorithms to give better forecasts.

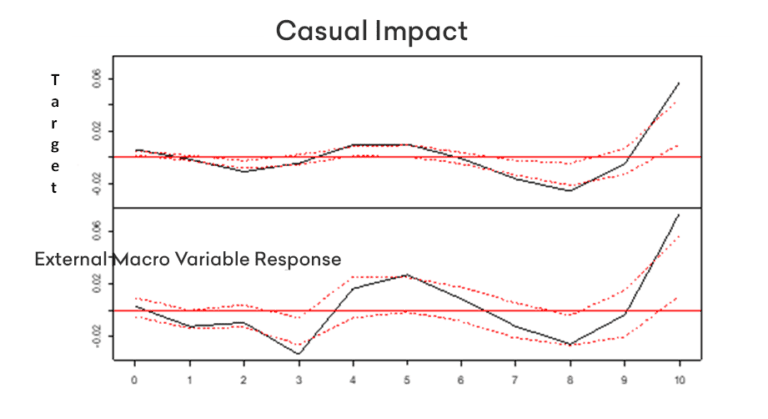

- Dynamic impact analysis (also called as causal impact analysis with respect to target variable – sales / demand volume) helps us in narrowing down factors (internal / external) from the complex data sources into ones that can precisely reflect changes over time i.e., highlight the causes or explains my target.

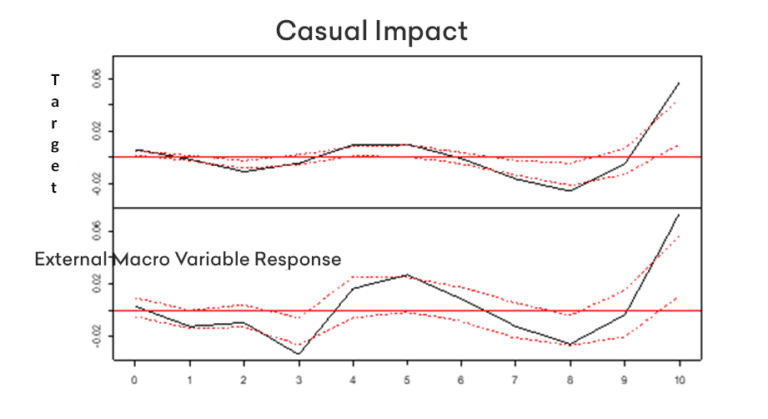

Example 1: Below graph provides the causal impact, lagged response against target variable. Key things it depicts: Impact is not very linear, lagged effect, and lag 5 seems to predict target better.

Example 2: Below graph provides the causal impact, lagged response against target variable. Key things it depicts: Impact is non-linear, multiple lagged effects, and dynamic response over time (cyclic response).

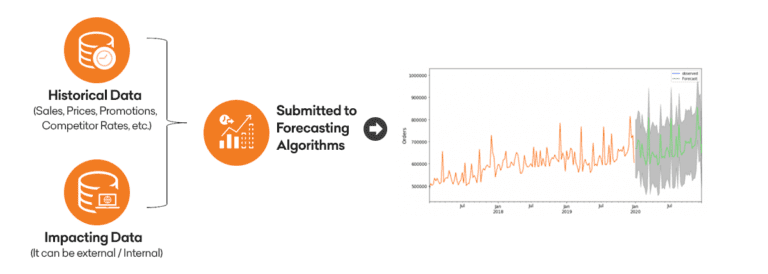

Once the factors are identified, the final step is about building AI algorithms

With the prepped dataset being ready, we can build AI forecasting through econometric models, that can provide optimum results. Later, the automated powered forecasting service can be deployed in the production environment.

At Factspan, we do forecast system by doing:

- Feature engineering

- Appropriate model search – can be of time-series econometric ones SARIMAX/Prophet or Boosting backed machine learning regressors or Deep AR (temporal fusions).

- And hyper parameter tuning, if required.

We then identify each feature/variable impact on sales/volume and its relevancy factor, as show below. Retailers can use it to better forecast numbers 4 to 5 weeks in advance, allowing better planning in their operations without losing margins.

For instance, a US retailer re-organized their shelves based on the forecast of current stocks. It reduced their obstructing goods by 60% from shelves and gave space to other fast-moving goods, thereby improving the sales by ~10% to 15% across various goods without compromising on the sales margins.

Want to know more? Talk to our experts